A New Dimension of finance & Wealth Awaits...

Guiding you towards prosperity with personalised financial solutions

and expert advice.

Our Expertise

With over 20 years of experience and a dedication to your success, we offer a full range of finance advisory services tailored to your unique goals. We're not just any finance company—we blend one-on-one coaching, our revolutionary app, and an expert advisory board to guide you every step of the way!

Our amazing team and cutting-edge software keep you informed and connected like never before. Get ready to take control of your finances with a personalised touch and a quirky twist. Let’s make your financial goals a reality!

Our Offerings

Unlock the potential of your finances with our range of strategic finance services.

Investment loans

re-Financing

debt consolidation

First Home Buyers

construction loans

Smsf loans SPECIALIST

ndis Finance

commercial loans

Development finance

asset Purchase and leasing

No Financials Loan

car loans

Equipment Loans

call us if the bank says no

private Loans

FINancial coaching

FINANCIAL MANAGEMENT

''over 30 lenders and 300 products to choose from''

Our experts work closely with you to create a personalised plan aligned with your financial objectives.

VIDEO OF OUR

RAPID MORTGAGE REDUCTION PROGRAM

RAPID MORTGAGE reduction PROGRAM

Our Rapid Mortgage Reduction program isn't just about crunching numbers – it’s about giving your finances a fresh, exciting twist! We provide personalised coaching that aligns your spending habits with your financial goals, ensuring every dollar you spend accelerates you toward financial freedom.

Our team guides you through goal-setting sessions and regular reviews, keeping you on track to reach your dreams. Say farewell to financial stress and hello to a brighter, more secure future with our comprehensive approach to mortgage management.

Our revolutionary software brings your mortgage management to life with vibrant graphs and interactive budgets on our app. Manage your finances in a whole new way, and stay connected with our team around the clock through real-time chat for on-demand support.

Experience our proven, battle-tested system exclusive to Goal Finance! You'll be amazed at how fast we can reduce your mortgage, putting you on the fast track to paying it off in record time—Formula One style!

Get ready to conquer your mortgage like a pro and zoom towards financial freedom!

FINANICIAL Coaching & Morgtgage Management

"Our dedicated team takes your home loan under its wing, keeping a watchful eye on your portfolio to ensure it's always performing at its peak. We're not just about safeguarding your wealth; we're all about supercharging it!

Through continuous optimization and proactive management, we tweak and fine-tune your home loan to give you the edge you need in the market. Think of us as your financial pit crew, working tirelessly behind the scenes to make sure your wealth engine runs smoothly.

With our expert insights and savvy strategies, you can rest assured that your home loan is in the best possible hands. Let us handle the nitty-gritty details while you sit back and watch your wealth grow!"

Welcome To Our Revolutionary Software

Wealth Vision

Available to You On Our APP or on a Desktop

FOR A LIMITED TIME ONLY

We are giving you FREE ACCESS yes...

Never been done before.

Take advantage of this today

Check it out here.....

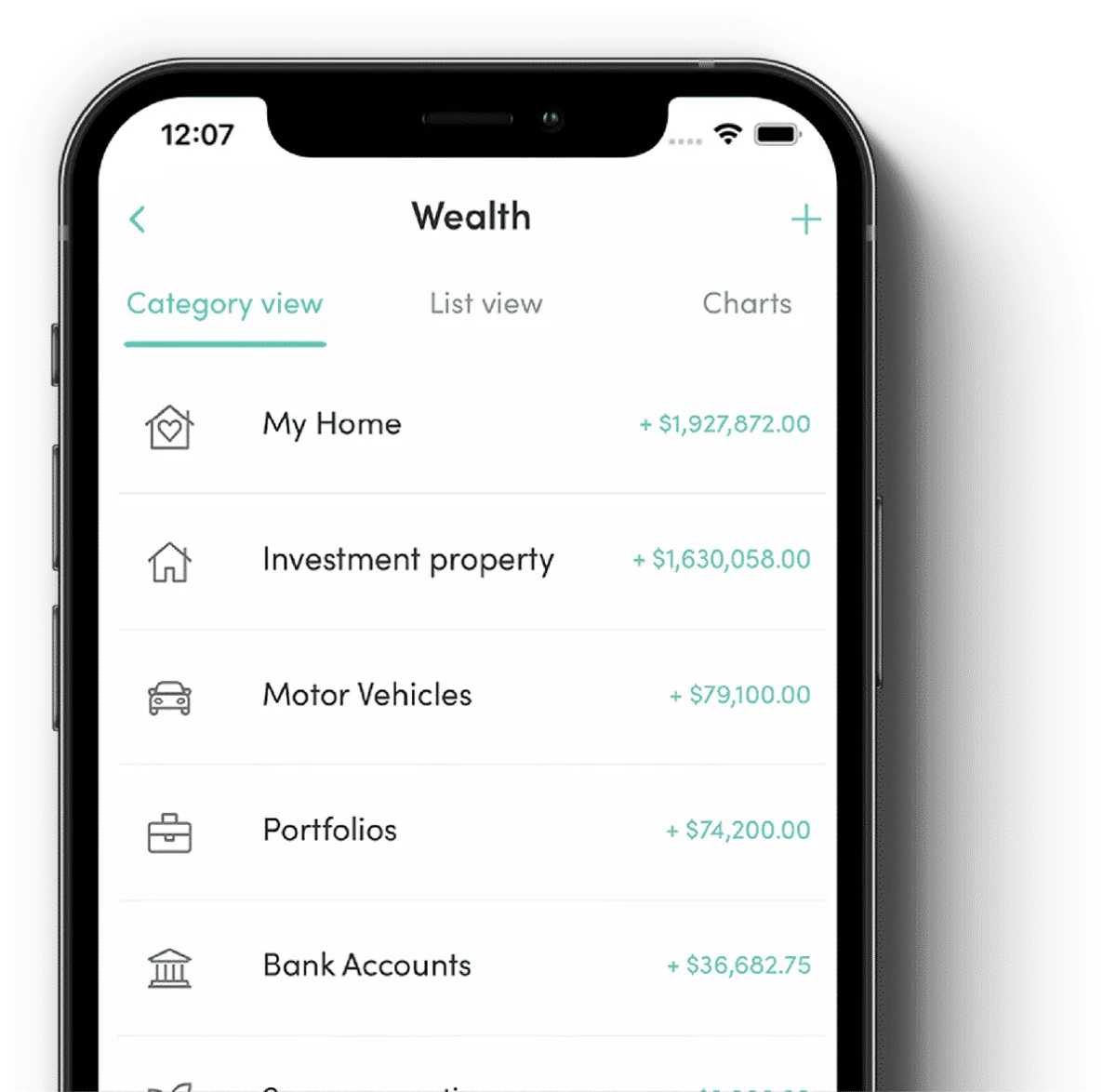

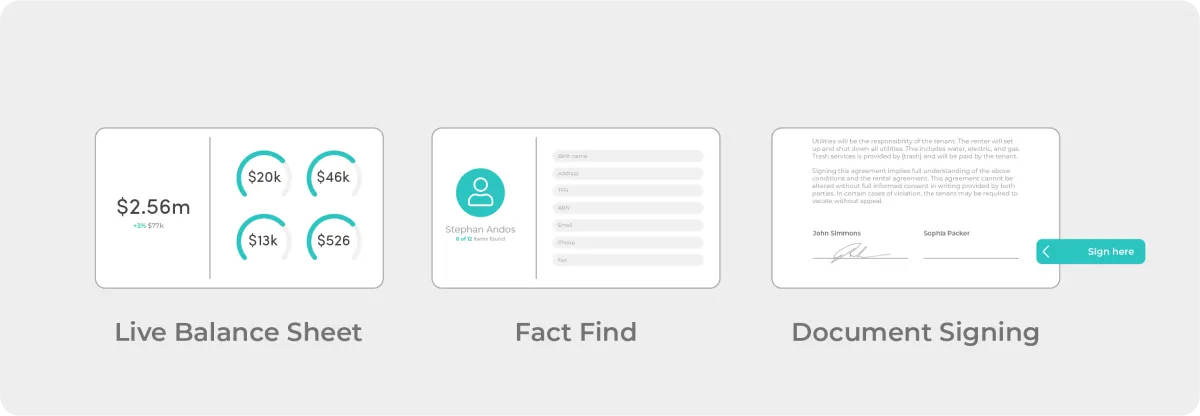

Wealth Vision My PROsperity software

Wealth Vision My Prosperity

is an award-winning platform designed for personal wealth management, integrating finance teams, accountants, planners, and lawyers to help you achieve your financial goals.

This revolutionary platform streamlines communication by centralising all channels. Securely share access with family, power of attorney, accountants, and finance brokers in one click.

Tax returns are simplified with automatic categorization of tax deductions from mortgagre Statements, bank statements. Manage budgets and goals efficiently, saving time and money for everyone involved.

Stay connected with a 24/7 chat hub for real-time communication with our team through the app.

Centralise your documents, including tax receipts, superannuation details, stocks, shares, bonds, SMSF, and legal documents for easy access.

See What Our Customer Say About Us

Chis Ditmar

Choosing Luke was the best decision we made for our financial journey. From start to finish, the service was beautifully set out and exceptionally smooth. Luke and his team did it all, from providing expert property investment advice to handling every detail of our home loan. Their professionalism and dedication exceeded our expectations, making the entire process stress-free and efficient.""The personalised guidance we received was invaluable. Luke took the time to understand our goals and tailored his advice to match our needs. He was always available to answer our questions, and his insights helped us make informed decisions that aligned perfectly with our financial objectives.""What stood out the most was their comprehensive approach. Not only did they secure an excellent home loan for us, but they also offered ongoing support and resources to ensure we stayed on track. Their commitment to our success was evident at every step, and we felt genuinely cared for throughout the entire process.""We highly recommend Luke to anyone seeking reliable and thorough financial services. His expertise in property investment and home loans is unparalleled, and his dedication to client satisfaction is truly commendable.Regards Chis

Jason Merrit

"Our financial journey took a remarkable turn thanks to Cruize and his team. These professionals stand out from the crowd – they are far from your typical mortgage brokers. Cruize delivered impeccable service, making the entire process seamless and well-organized.""The innovative software and tools they use set them apart. Their app was a revelation, providing clear and real-time updates. Being part of their Debt Reduction Program, I now have a clear understanding of my financial standing at all times. Life is sweeter and more manageable thanks to Cruize and his team's outstanding efforts.""The personalised guidance we received was second to none. Cruize took the time to understand our financial goals and customised their advice to suit our needs. They were always available to answer our questions, and their expert insights helped us make informed decisions that perfectly aligned with our financial objectives.""What impressed us most was their holistic approach. They not only secured an excellent home loan for us but also provided continuous support and resources to ensure we stayed on track. Their dedication to our financial success was evident at every stage, and we felt truly cared for throughout the entire process.""We wholeheartedly recommend Cruize to anyone in need of reliable and comprehensive financial services.

Tony De Candia

"Working with Cruize at Goal for my first home purchase, a house and land package, was an excellent experience. Their advice and guidance were exceptional throughout the process. From start to finish, they managed all the finer details, including liaising with my builder and agent.""Goal Finance system and communication were outstanding. Their app was particularly useful, providing real-time updates and making the entire experience pleasant and transparent.""I truly appreciate how Goal took care of everything seamlessly. Their professionalism and attention to detail ensured that every aspect of the transaction was handled efficiently.""Thank you, Goal, for your exemplary service and support. I highly recommend Goal to anyone looking for a smooth and professional home buying experience."

MEET OUR TEAM

Luke Papandrea- CEO Founder

Finance,Investment, SMSF and Property Expert

With 25 years of experience as a financial mortgage broker, brings a wealth of knowledge and expertise to his field. His background in financial planning and experience as a property agent specialising in self-managed superannuation funds (SMSF) and investment and commercial properties equips him with a comprehensive understanding of the intricacies of the mortgage and property markets. With such a diverse skill set, Luke likely offers his clients tailored advice and solutions to meet their specific financial needs.

Cruize Papandrea-

Senior Lending Manager Adelaide

Cruize epitomizes dedication to his craft, boasting a distinguished career as a highly qualified mortgage broker. Armed with a Diploma in Financial Management, Cruize's expertise spans the entire spectrum of financial services, from refinancing to purchasing and even securing car loans. This is what truly sets Cruize apart is his role as the manager of the financial coaching department, where he specialises in empowering individuals to turn their aspirations into reality. With his guidance, clients embark on transformative journeys, fulfilling their dreams and realising their fullest financial potential.

Dax Singh

Mortgage Broker

Dax is a dedicated mortgage broker who brings passion and personalised attention to each client. With a strong background in finance and customer relationships, Dax specialises in guiding clients confidently through the mortgage process. His affinity for numbers and genuine commitment to supporting clients in achieving their financial goals ensures exceptional service. Whether assisting first-time buyers or seasoned investors, Dax empowers his clients to make informed decisions and reach their dreams quickly.

Raya Bocian-

Senior Lending Manager Melbourne

Raya stands as a beacon of excellence in the mortgage brokerage realm, armed with a decade of honed expertise. Her journey as a highly trained mortgage broker has been marked by a steadfast commitment to her clients' financial well-being. With each passing year, Raya's proficiency has deepened, allowing her to navigate the intricacies of the mortgage landscape with finesse and precision. Her wealth of experience serves as a testament to her dedication and passion for empowering individuals on their homeownership journey. Raya's clients undoubtedly benefit from her seasoned guidance and unwavering dedication to securing the best possible outcomes..

Tony Manto-

Coaching Specialists

Tony radiates an unparalleled passion for coaching and mentoring, igniting transformative journeys for over three decades within the realm of sales. His expertise extends far beyond conventional boundaries, encompassing expert goal-setting, financial acumen, and business coaching. Tony's unwavering commitment to personal and professional development has propelled countless individuals and businesses to unprecedented heights of success. With Tony as your guide, your journey towards financial and personal fulfillment will transcend limits, as he empowers you to reach new horizons of achievement. Let Tony illuminate the path ahead and hold you accountable every step of the way, ensuring that your aspirations become triumphs.

Stella Xiong-

Goal Residential

Property Management Expert

Stella stands as a paragon of excellence in property management, equipped with a unique engineering background that infuses her work with unparalleled attention to detail. Her meticulous and carefully crafted approach sets a new standard of precision, ensuring that every aspect of your financial and property investment needs is not just met, but exceeded. With Stella at the helm, you can rest assured that every box is not only ticked but thoroughly examined and optimised to maximize your success. Experience the assurance of working with a fully qualified professional whose dedication to perfection elevates your investment journey to extraordinary heights.

Frequently Asked Questions

Find answers to common inquiries about our financial advisory services.

What Services Do Mortgage Brokers Provide?

A mortgage broker provides invaluable services to individuals seeking financing for purchasing property, whether it be for residential or commercial purposes.

Here are some of the key services a mortgage broker typically provides, along with the added benefit of often being available at no cost to the borrower:

Expert advice and guidance:

Mortgage brokers offer personalised advice tailored to your financial situation and goals. They help you understand the various types of mortgages available and assist you in selecting the one that best suits your needs.

Access to multiple lenders:

Unlike banks or direct lenders, mortgage brokers have access to a wide network of lenders, including banks, credit unions, and private lenders. This allows them to shop around on your behalf to find the most competitive loan terms and interest.

Comparison and Negotiation:

Mortgage brokers analyse and compare loan products from different lenders, considering factors such as interest rates, fees, and repayment terms. They negotiate with lenders to secure favourable terms on your behalf, potentially saving you money over the life of the loan.

Application Assistance:

Mortgage brokers assist with the loan application process, helping you gather and organise the necessary documentation. They streamline the application process and ensure that all paperwork is submitted accurately and on time. Counselling and Improvement: Some mortgage brokers offer credit counselling services to help borrowers improve their credit scores. They provide advice on managing debt, resolving credit issues, and improving creditworthiness, which can increase your chances of qualifying for a mortgage with favourable terms.

Pre-Approval Services:

Mortgage brokers can help you obtain pre-approval for a mortgage, which gives you a clear understanding of how much you can afford to borrow. This strengthens your position when making offers on properties and demonstrates to sellers that you are a serious buyer.

Continued Support and Assistance:

Even after your loan is approved, mortgage brokers provide ongoing support and assistance. They address any questions or concerns you may have throughout the home buying process and beyond, ensuring a smooth and stress-free service with no upfront costs. Perhaps one of the most significant advantages of working with a mortgage broker is that their services are typically free to borrowers. They are compensated by the lender once the loan is funded, so there are no upfront costs or out-of-pocket expenses for you.

Overall, partnering with a mortgage broker not only simplifies the mortgage process but also increases your chances of securing the best possible loan terms and saving money in the long run.

How Do I Choose the Right Finance Broker?

Choosing the right mortgage broker is crucial to ensuring a smooth and successful home buying experience.

Here are some key factors to consider when selecting a mortgage broker:

Reputation and Experience:

Look for a mortgage broker with a solid reputation and extensive experience in the industry. Research online reviews, ask for recommendations from friends or family members, and enquire about the broker's track record of success.

Credentials and licencing:

Ensure that the mortgage broker is properly licensed and accredited. Check if they are a member of professional organisations such as the Mortgage & Finance Association of Australia (MFAA) or the Finance Brokers Association of Australia (FBAA). These affiliations indicate a commitment to high ethical standards and ongoing professional development.

Access to a Wide Network of Lenders:

Choose a mortgage broker who has access to a diverse range of lenders, including major banks, credit unions, and non-bank lenders. A broker with a broad network can offer you more options and increase your chances of finding a loan that meets your needs.

Communication and responsiveness:

Pay attention to the broker's communication style and responsiveness. You want someone who is accessible, attentive to your needs, and willing to answer your questions promptly. Clear and transparent communication is essential throughout the mortgage process.

Personalised Service:

Seek out a mortgage broker who takes the time to understand your unique financial situation and goals. They should offer personalised advice and tailor their recommendations to suit your specific needs, rather than taking a one-size-fits-all approach.

Transparency and Integrity:

Choose a mortgage broker who operates with transparency and integrity. They should fully disclose their fees and commissions upfront and provide you with all the information you need to make informed decisions. Avoid brokers who pressure you into taking loans that may not be in your best interest.

Local Market Knowledge:

Consider working with a mortgage broker who has in-depth knowledge of the local property market and lending landscape. They should be familiar with local regulations, property values, and lending practices, which can be invaluable when navigating the home buying process.

Referrals and References:

Don't hesitate to ask the mortgage broker for references or testimonials from satisfied clients. Hearing about others' experiences can give you insight into what it's like to work with the broker and help you make an informed decision.

Considering these factors and conducting thorough research, you can choose a mortgage broker who is the right fit for your needs and preferences, ultimately making your home-buying journey a smooth and successful one.

What Is the Importance of Mortgage Brokering ?

The importance of a mortgage broker cannot be overstated, as they play a pivotal role in the home buying process for both individuals and businesses.

Here are several key reasons why mortgage brokers are essential:

Expertise and guidance:

Mortgage brokers are experts in the field of home financing. They possess in-depth knowledge of the mortgage market, including various loan products, interest rates, and lending criteria. This expertise allows them to provide valuable guidance and advice to borrowers, helping them navigate the complexities of the mortgage process with confidence.

Access to a Wide Range of Lenders:

One of the most significant advantages of working with a mortgage broker is their access to a vast network of lenders, including banks, credit unions, and non-bank lenders. This extensive network gives borrowers access to a wide range of loan options and increases their chances of finding a mortgage that suits their needs and financial situation.

Customised Solutions:

Mortgage brokers take the time to understand each client's unique financial situation, goals, and preferences. Based on this information, they can tailor their recommendations and offer customised solutions that align with the borrower's objectives. Whether you're a first-time homebuyer, a seasoned investor, or looking to refinance, a mortgage broker can help you find the right loan for your specific needs.

Time and effort:

Shopping for a mortgage can be time-consuming and overwhelming, especially for those unfamiliar with the process. Mortgage brokers streamline the process by doing the legwork on behalf of their clients. They research loan options, negotiate with lenders, and handle the paperwork, saving borrowers time and effort while ensuring a smooth and efficient.

Advice and Education:

Mortgage brokers not only help borrowers secure financing but also provide valuable financial advice and education along the way. They can explain complex concepts, such as interest rates, fees, and mortgage terms, in a clear and understandable manner, empowering borrowers to make informed decisions about their finances.

Negotiation Power:

Mortgage brokers advocate for their clients' best interests when negotiating with lenders. They leverage their industry knowledge and relationships with lenders to secure favourable loan terms, including lower interest rates, reduced fees, and flexible repayment options. This negotiation power can result in significant cost savings for borrowers over the life of their mortgage.

Ongoing Support:

A mortgage broker's role doesn't end once the loan is closed. They continue to provide support and assistance to their clients throughout the life of the mortgage. Whether you have questions about your loan, need advice on refinancing, or want to explore new financing options, your mortgage broker is there. In summary, the importance of a mortgage broker lies in their ability to simplify the home financing process, provide expert guidance and advice, and ultimately help borrowers find the best mortgage solution for their needs.

Whether you're buying your first home, refinancing an existing mortgage, or investing in property, a mortgage broker can be an invaluable ally every step of the way.

How Can I Pay My Loan Off Faster?

What We Offer:

1. Specialised Coaching:

Personalised Guidance:

Our expert coaches will work with you to create a customised plan tailored to your financial situation and goals.

Regular Check-ins:

We provide ongoing support and adjustments to your plan to ensure you stay on track.

2. Budgeting Services

Detailed Budget Analysis:

We help you understand your income, expenses, and spending habits.

Savings Strategies:

Identify areas where you can cut costs and allocate more funds towards paying off your mortgage.

Debt Prioritisation:

Learn how to prioritise debts to reduce interest payments and eliminate debt faster.

3. Rapid Mortgage Reduction Techniques:

Bi-Weekly Payments:

Make payments every two weeks instead of monthly to reduce interest and pay off your mortgage faster.

Lump Sum Payments:

Learn how and when to make lump-sum payments without penalties.

Refinancing Options:

Evaluate if refinancing your mortgage at a lower interest rate is a viable option.

Benefits of Our Program:

Save thousands on interest payments: By paying off your mortgage faster, you reduce the total interest paid over the life of the loan.

Achieve Financial Freedom Sooner:

Free yourself from the burden of debt and enjoy greater financial

Support:

Benefit from the knowledge and experience of our financial experts.

Schedule a consultation:

Contact us to set up a free initial consultation with one of our specialised coaches.

Create a Custom Plan:

Work with your coach to develop a detailed plan that fits your unique financial situation.

Implement and Adjust:

Start following your personalised plan with regular check-ins and adjustments as needed.

Client Testimonials:

"Thanks to the Rapid Mortgage Reduction Program, we paid off our mortgage 10 years early and saved over $50,000 in interest!" - The Elliott Family

What Loan Options Are Suitable for Me?

Which Loan Options Are Suitable for You?

Finding the right loan can be challenging. Here’s a guide to help you understand the best options based on your financial needs and goals.

1. Fixed-Rate:

Best For:

Homebuyers who plan to stay in their home for a long period. Those who prefer predictable monthly payments.

Features:

The interest rate remains constant throughout the life of the loan. Stability in monthly payments.

2. Variable rate:

Best For:

Homebuyers who plan to move or refinance within a few years. Those who expect their income to increase in the future.

Features:

Lower initial interest rate compared to fixed-rate mortgages. The interest rate may change periodically based on market conditions.

3. FHA Loan:

Best For:

First-time homebuyers or borrowers with lower credit scores or limited funds for a down payment.

Features:

Lower down payment requirements (as low as 3.5%).

Easy credit qualification.

4. VA Loan:

Best For:

Veterans, active-duty service members, and their families.

Features:

No down payment. private mortgage insurance (PMI).

Competitive interest rates

5. USDA Loan:

Best For:

Homebuyers in eligible rural and suburban areas.Borrowers with low to moderate incomes.

Features:

No down payment required.Low mortgage insurance premiums.

6. Jumbo Loan:

Best For:

Homebuyers are purchasing high-value properties. Borrowers with strong credit scores and higher incomes.

Features:

Financing for loan amounts that exceed conforming loan limits.Typically higher interest rates and stricter credit requirements.

7. Home Equity Loan:

Best For:

Homeowners looking to borrow against the equity in their home.Those needing funds for significant expenses like home improvements or debt consolidation

Features:

Lump sum payment with a fixed interest rate.Fixed monthly payments over the loan term.

Look at different lenders and loan products to find the best fit for your needs.

Need More Help?

Contact us for personalised guidance and to explore the loan options that best suit your financial situation.

How long does it take for approval?

How Long Does It Take for Loan Approval?

The loan approval process can vary depending on the type of loan, the lender, and your individual circumstances. Here’s an overview of the typical timelines for different types of loans, including SMSF loans.

1. Mortgage Loans:

Pre-Approval:

Timeframe: 1-3 days

Details:

During this stage, the lender reviews your credit history and basic financial information to provide a pre-approval letter, which shows sellers you’re a serious buyer.

Full Approval Timeframe:

30-45 days

Details:

The process involves an in-depth review of your financial documents, an appraisal of the property, and final underwriting. Factors such as the complexity of your financial situation and the lender's efficiency can affect this timeframe.

2. Personal loans:

Timeframe:

1-7 days

Details:

Online lenders often offer faster approval times, sometimes within a day or two if you have all necessary documentation ready.

Traditional banks/credit unions:

Timeframe:

1-2 weeks

Details: These institutions may take longer due to more thorough vetting processes and less automation.

3. Home Equity Loans/Lines of Credit (HELOC):

Timeframe: 2-4 weeks

Details: The lender needs to evaluate your home’s value and your equity, which includes an appraisal and underwriting.

HELOC:

Timeframe:

2-6 weeks

Details: Similar to home equity loans, but may take longer due to the revolving credit line structure.

4. Auto Loans:

Dealership Financing:

Timeframe:

Same day to 1-2 days

Details:

Many dealerships offer on-the-spot financing, often with rapid approval from Union Financing.

Timeframe:

1-7 days

Details:

Approval might take longer compared to dealerships, especially if the bank or credit union needs more detailed financial information.

5. Small business loans:

SBA Loans:

Timeframe:

30-90 days

Details:

Small Business Administration (SBA) loans involve a detailed review process, including business plans and financial statements.

Timeframe:

2-4 weeks

Details:

Banks require comprehensive financial documentation and business lenders.

Timeframe:

1-7 days

Details: Online lenders typically offer faster processing times for small business loans, although at higher interest rates.

6. SMSF Loans:

Best For:

Individuals looking to use their self-managed super fund (SMSF) to invest in property.

Pre-Approval Timeframe:

1-2 weeks

Details:

Lenders will review your SMSF structure, trust deed, and investment strategy to ensure compliance with lending criteria.

Full Approval Timeframe:

4-6 weeks

Details: This involves a comprehensive review of your SMSF documentation, property valuation, and finalizing loan terms. The complexity of SMSF regulations can extend the approval process.

Factors Influencing Loan Approval Times:

Documentation Preparedness:

Having all necessary documents ready (income verification, tax returns, identification) can speed up the loan.

History:

A strong credit history can lead to quicker approvals, as less scrutiny is needed.

Lender Efficiency:

Some lenders are equipped with more efficient processing systems and can offer quicker turnaround times.

Complexity of Application:

More complex financial situations or larger loan amounts may require more thorough evaluations and longer approval times.

Speed Up the Approval Process:

Gather All Necessary Documents in Advance:Prepare income statements, tax returns, credit reports, and identification.

Maintain Good Credit:

Ensure your credit score is in good standing to facilitate smoother approvals.

Promptly Respond to Lender Requests:

Quickly provide any additional information or documentation requested by the lender.

Choose the Right Lender:

Research and select a lender known for efficient processing times.

Need Help with Your Loan Application?

Contact us for personalized assistance to expedite your loan approval process.